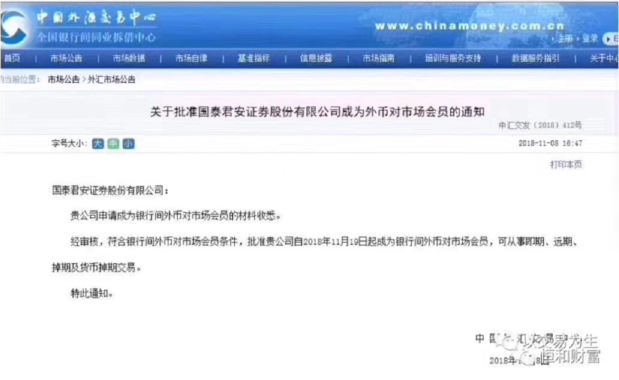

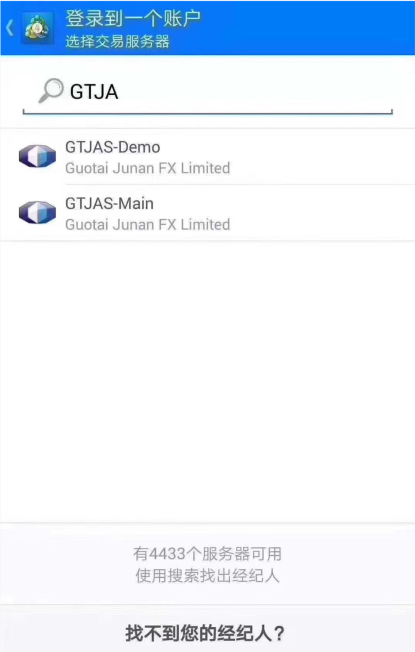

First Chinese Securities Broker Guotai Junan Securities acquires Forex License for mainland China11/19/2018 According to the Chinese Forex Trading Center (ChinaMoney.com.cn), on November 19 the 1st Chinese Securities Broker Guotai Junan Securities (国泰君安证券) has successfully acquired its Forex License for “Interbank FX Trading” to do business in mainland China. The license covers “spot FX, futures and swap currency trading operations”. This may mark a major milestone in the evolution of the Chinese government views towards the Forex sector, which has been going through some turbulent changes over the last 12 months. The FX trading services will be provided via MT4 Trading terminal, which has already established itself as a clear market favorite among the Chinese trading community. Guotai Junan Securities was originally founded in Hong Kong. In order to become a client of Guotai Junan one would need to be a holder of the Hong Kong bank account with HKD. It will be offering 1:20 leverage. However, the fees are markedly larger than any of the market leading overseas brokers. According to sources familiar with the case, “the fees on one standard lot would be $200 USD and the spread of 1%”.

“Although these news can be interpreted as a promising signal from the Chinese authorities of a potential market easing for foreign players, the existing leverage and trading terms will hardly make any significant changes among the regional traders’ choices of trading venues”, - mentioned Pavel Khizhnyak, Founder of Trade Exact Consulting. “Gradual and very calculated reforms in the FX sector in China are to be expected, however, I believe the resulting regulatory framework will be in line with the regional practices of Hong Kong, Japan and South Korea, who have gone through the similar changes in the past bringing very tight leverage restrictions of 1:20, 1:25 and 1:10 respectively”, - he added. According so some industry insights, the share of China in the margin FX trading currently holds at 30% of the global FX trading volume, so the industry should continue to monitor closely the upcoming changes in the local landscape. Will this be a one-off experiment (which we a few back in 2007 and 2008) or a start of a market liberalization under the WTO umbrella, this remains to be seen.

3 Comments

|

AuthorPavel Khizhnyak, Founder & CEO Archives

April 2019

Categories |

RSS Feed

RSS Feed