|

By Pavel Khizhnyak, TradeExact Consulting Founder/CEO With the largest economy in the word by purchasing power parity, biggest community of stock traders, smartphone users, and by some estimates, up to 30% of the OTC retail FX trading volume - its every broker’s dream to make it big in China. The first FX brokers have been trying to penetrate this market since 2004, yet only a handful of them have truly succeeded. Meanwhile to most others the market remains largely an unattainable dream. So what does it take to really make it in China? And can you do it remotely? In this article we will review the key differentiators between the stunning success stories and epic failures in the Greater China Region. In essence, it really comes down to just one simple thing – your business needs to be on the ground. You need to have localized products and services, marketing, sales, IT, support staff and key decision makers right there and then. Why so? Let’s review. 1. Face To Face Business Culture It’s no secret to anyone familiar with sales that the ability to meet a client face to face greatly increases the chances of a successful sale. However, when dealing with any Chinese partners this becomes not just a “nice to have” preference, but rather a “must have” business requirement. Although the first attempts at providing margin FX trading in China date back to mid-1990s, the real first wave of forex market entrants came around 2004. While some were very respectable brands with solid business models, long term market investment plans and some even went as far as registering with the State Administration of Foreign Exchange, unfortunately there were many fly-by-night brokers and quite a few straight up scams, which left many traders locked out of their deposits and IBs were left "holding the empty bags". Another few points to consider are not-willingness to comply with stringent KYC requirements, desire to be able to fund accounts with any 3rd party PSP systems that support China Union Pay, large leverage preferences and complex rebate&commission structures of local Introducing Brokers and Money Managers made it increasingly difficult for FCA, ASIC and CySEC brokers to directly on-board clients in the region. This lead to a shift towards the offshore based “sister” companies or less stringent regulation destinations (e.g. Labuan, Vanuatu, etc.). Naturally, these regulations don’t provide an easy to use channel of dispute resolution for their brokers’ clients, don't have strict capital adequacy requirements and hardly any enforcement tools. In absence of such channels, the only viable “guarantor” of the safety of funds for the retail trader and/or Introducing Broker becomes the local sales rep. This local sales rep is physically based in China and can visit the introducing brokers’ office, provide training to the local staff when needed and always be on standby ready to answer questions in the same time zone. On top of that, there is also a cultural aspect of sealing business deals at the dinner table or KTV after party. The final decisions are often made not based on the objective analysis of the deal structure, but rather subjectively based on whether or not the Chinese counter-party finds the account executive “靠谱”, i.e. reliable and trustworthy. Not surprisingly, during a sales job interview in China it is not uncommon to hear a question “how much can you drink?” or even to see candidate showcase their drinking abilities among top skills in their CVs. 2. Hiring Local Staff One of the first Chinese words any foreigner learning Chinese would hear about himself is “老外”, which literally means “always foreign”. However, I believe it carries a deeper meaning. It doesn’t’ really matter how great you think you speak the language or know the culture. At the end of the day – you will always remain an outsider. From a business standpoint, the conclusion is simple – although it pays off to have a professional foreign executive who speaks the language to meet with the high profile clients, you should always rely on your local Chinese team to interface with the customers and handle the nitty-gritty daily routine work. This is the only way to remove cultural barriers and create that critical component of trust, much needed to swing the buying decision in your favor. 3. Renting Permanent Office Space When having a friendly local person is not enough, the next big decision-making driver is whether or not you have a local office in China. Companies that invest into local offices and especially those who are not afraid to invite their local partners to visit, are considered to be the prime candidates for cooperation. This holds especially true for larger size partnership deals. The reason is simple and quite pragmatic. Renting a permanent office space requires a local company license and 3 to 6 month security deposit. So should any disputes arise, the clients or partners are less likely to go to court, but would much rather prefer to physically occupy your office space and disrupt your office operations until your company can find a resolution suitable for both sides. This is usually accompanies with a large banner stretched across the office corridor with the client's or partner's complaints. 4. Breaking through the Great China Firewall It can be argued that the actual Great Wall of China was breached by Tatars and Mongols, and therefore, did not serve its purpose when really needed. The Great China Firewall on the other hand is a formidable and very effective obstacle to be reckoned with to this day. And its grip on control of every digital information exchange on public networks inside China is growing day by day. If you think that simply translating your website into Chinese will be your winning ticket to the local market, you are up for a bitter disappointment. Here are some serious reasons why. Any website host that is located outside of mainland China is viewed by local ISPs (Internet Service Providers) as foreign and therefore not approved by local authorities, deemed not safe. So why should the ISP bother to provide you with the connectivity to it? You can test it out by simply putting your website URL into one of the Chinese website loading speed tester sites (e.g. http://ping.chinaz.com). Chances are, you will discover that it is very slow or doesn’t open up at all in quite a few provinces. Same goes for ESPs (email service providers). If your email server is hosted outside of China, most likely, the major ESPs like QQ, Sina and 163.com will see it as spam and your email marketing campaigns will never reach their target or end up in spam folders at best. Yet, not all is lost. There are 2 ways to make sure you can work “inside the wall”. The best way is to get a local ICP license. The process has gotten more complicated and much more expensive over the last few years. It will also cost you between $10K to $14K USD and may take about 1-2 months to complete. Besides, there is no guarantee that you will actually pass the regulator’s requirements, because the website you are getting an ICP license for must have a license to provide it’s services in China. But if you do get it and ICP, you can officially host your server inside China, which will ensure the maximum loading speeds and email deliverability on par with the local providers. For those, who can’t obtain the ICP license, a Hong Kong hosting option is still available. It is much cheaper with just a few hundred dollars a month and can be setup in a matter of weeks. Of cause, it will not be as fast as a native ICP hosted server, but will still be within an acceptable range. However, emails are slowing dying out and if you really need to grab your clients’ attention, you have to go social. 5. Getting Social with WeChat If you aim to build any serious following in China and build an effective communication channel, WeChat is a way to go. WeChat is like Facebook on steroids. Effectively if you have WeChat with a bank card attached to it, you can do almost anything – chat, video calls with friends, post moments, send/receive money, pay for utilities, order taxi, book air/train tickets, go to movies, go shopping and much more. For those reasons, it is already at 900 million users and growing strong. There are 2 main ways how companies can utilize WeChat: 1) Corporate Subscription/Service Account and 2) Corporate Developer Account. The Subscription/Service accounts allow you to publish articles, create engaging H5 animated promotions and message your follower clients directly. The Developer Account offers WeChat API, which you can use to make seamless integration with your Member Area or other online portals. Having your sales and marketing team share your corporate WeChat posts makes it easy for clients and partners to share as well, which makes a much more engaging ecosystem than email marketing. Needless to say, that for either option you would need to have a local company license in China or work with an agency that can help you with that. However, be mindful that an agency can cancel the contract at any time, which means that you would need to start building your followers from scratch should that happen. 6. Decision-making Speed

Last, but definitely not least, is the decision-making speed. Through my 14+ years in the market I have seen countless examples of lost deals worth millions of dollars, simply because a company failed to respond to a client or partner's request in less than an hour. You have to always remember that no matter what you think about your brand and how much you love your product, to a large Chinese partner you are just another 老外 (“always foreign”) provider, and there are always several hungry local competitors waiting to get a shot at the same deal should you fail to reply in time. As the old saying goes - time is money. In China – the time flies faster. And whoever is the fastest – can usually make the most money. Therefore, we advise to establish your business processes, design the decision-making and approvals in a way that it could be done within the same time-zone. Only this way you can compete with more established and well entrenched companies with local presence and get a fighting chance at your “Big China Dream”. Greater China Region is probably one of the toughest markets out there, but with the right dedication and efforts invested – it can certainly become your best market ever. In TradeExact Consulting, we have a highly professional and experienced team on the ground in China who can help you avoid costly mistakes and start your Chinese business in the most efficient way possible.

0 Comments

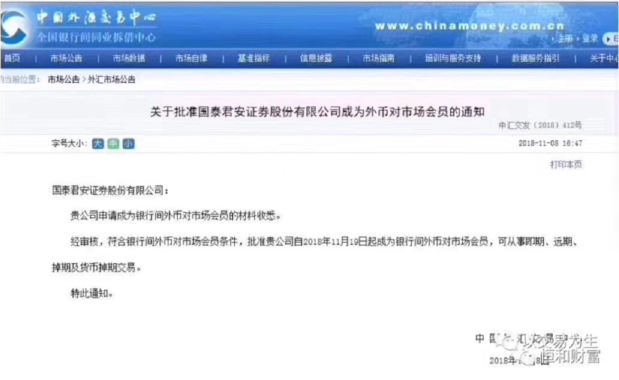

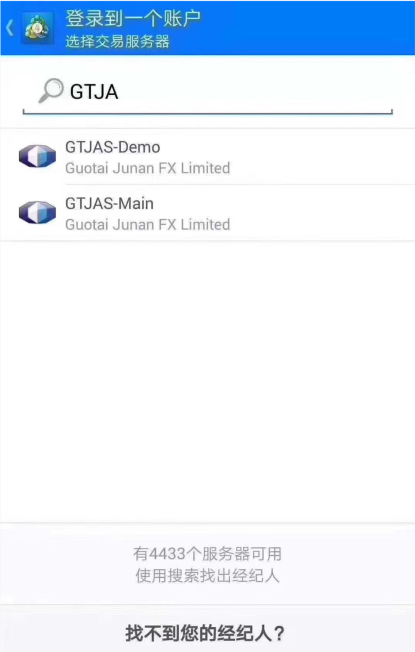

First Chinese Securities Broker Guotai Junan Securities acquires Forex License for mainland China11/19/2018 According to the Chinese Forex Trading Center (ChinaMoney.com.cn), on November 19 the 1st Chinese Securities Broker Guotai Junan Securities (国泰君安证券) has successfully acquired its Forex License for “Interbank FX Trading” to do business in mainland China. The license covers “spot FX, futures and swap currency trading operations”. This may mark a major milestone in the evolution of the Chinese government views towards the Forex sector, which has been going through some turbulent changes over the last 12 months. The FX trading services will be provided via MT4 Trading terminal, which has already established itself as a clear market favorite among the Chinese trading community. Guotai Junan Securities was originally founded in Hong Kong. In order to become a client of Guotai Junan one would need to be a holder of the Hong Kong bank account with HKD. It will be offering 1:20 leverage. However, the fees are markedly larger than any of the market leading overseas brokers. According to sources familiar with the case, “the fees on one standard lot would be $200 USD and the spread of 1%”.

“Although these news can be interpreted as a promising signal from the Chinese authorities of a potential market easing for foreign players, the existing leverage and trading terms will hardly make any significant changes among the regional traders’ choices of trading venues”, - mentioned Pavel Khizhnyak, Founder of Trade Exact Consulting. “Gradual and very calculated reforms in the FX sector in China are to be expected, however, I believe the resulting regulatory framework will be in line with the regional practices of Hong Kong, Japan and South Korea, who have gone through the similar changes in the past bringing very tight leverage restrictions of 1:20, 1:25 and 1:10 respectively”, - he added. According so some industry insights, the share of China in the margin FX trading currently holds at 30% of the global FX trading volume, so the industry should continue to monitor closely the upcoming changes in the local landscape. Will this be a one-off experiment (which we a few back in 2007 and 2008) or a start of a market liberalization under the WTO umbrella, this remains to be seen. Baidu is tightening it's grip on forex ads in China: is this where direct client acquisition ends?6/26/2016  It’s not a secret that for brokers operating on a B2C model in China, Baidu generates the vast majority of leads. On June 24th Chinese media sites reported that according to an unnamed Baidu’s official, the decree came down to stop ads by forex brokers starting at 00:00 June 25th. The only exception is made for FX brokers with licenses from US, UK and Hong Kong (NFA, FCA and SFC regulators respectively). The news comes only 2 weeks after Baidu had already announced the blanket ban on binary broker ads. News is a sobering shower for forex brokers in China who used to rely on the direct client acquisition models. Baidu holds 70% of the entire search traffic in China showing about 6,000,000 searches per month related to Forex and Binary. Although for those lucky few with the right licenses this comes as an early Christmas present, for the majority of others it’s time to rethink their marketing strategy and re-allocate their budgets. With the announcement of the ban on FX and binary ads, most FX brokers are reporting sharp spikes of their SEM CPA and the number of brokers advertising on Baidu has visibly reduced. All of these changes is part of Baidu’s recent campaign to clean up it’s advertisers after the viral social video of Zexi Wei – a 21 year old cancer patient, who died after receiving an unsuccessful treatment from a clinic he found on Baidu’s paid search. So does this mean the end of road for retail forex in China? I don’t think so. Although, on one hand, it definitely complicates the lives of many well established retail forex brands who used to rely on the B2C model more than on B2B for China. On the other hand, the demand is still there and market is still growing. It will simply be rerouted to different channels - the main one being IBs and money managers, which has been a prevalent business model in China for many years. Alternatively, in the last few years, social media, mobile app development, various forms of DSP campaigns and even offline activities have been increasingly rising. The CPL from Baidu grew more than 20 folds in the past 10 years. So finding new marketing channels has been a priority to the majority of the serious players in the market who noticed the trend early. This is precisely what we have been focusing on at TradeExact as well. What’s next? The evolution of the Baidu’s official stance on FX ads is slowly taking shape towards stricter and widely recognized regulating bodies. A couple years ago the “while list” of regulators included NFA, FCA, CySEC, ASIC and the New Zealand’ FSPR. The relative ease with which one could obtain the NZ license has led to a number of fraudulent cases in the market, so it wasn’t a surprise when NZ was the first one to get off the list. The large number of customer complaints against IronFX in China is what probably sealed the fate of CySEC. However, what’s unclear is why ASIC as well was excluded from the list. With the vast majority of market leaders being FCA regulated this is the last frontier for FX brokers. Will this arrangement hold after the Brexit? We shall see in the next year or two. Those with the right marketing mix and unique acquisition channels will win with or without Baidu. I have been doing business in China for over 10 years and personally ran several Representative Offices and consulting firms in Beijing and Shanghai. In Trade Exact Consulting, we see a lot of customers making same mistakes when coming into China and would like to share some tips on how to avoid them. Despite the recent economic slowdown China remains a top destination for financial firms aiming to expand their global presence. Over the past 5 years it’s become common practice among foreign entrants to choose Wholly Foreign Owned Enterprise (WFOE) instead of a traditional Representative Office (RO) as an incorporation format in China. In this article we will review the main misconceptions about establishing your business presence in China and will share some little known insights on how to save tens of thousands of dollars along the way. Misconception # 1. Representative Office is the best way of incorporation in China. Traditionally most companies contact us to inquire about the office setup in China, they initially gravitate towards Representative Office. If 10 years ago, it was a commonplace practice and was the fastest and easiest way to get in, over the years it was replaced with a Wholly Foreign Owned Enterprise, aka WFOE alternative. And there are at least 12 reasons why you too should stay away from a Rep Office and establish a WFOE instead.

So in which cased does it actually make sense to establish a Representative Office given all its limitations as described above?

Nowadays, Rep Office remains a rare choice of those multi-national companies that are simply looking to establish a foothold in China without hiring any more than 1-2 people staff and without conducting any type of business activities. What type of WFOE do most financial companies choose? Until recently, the vast majority of the WFOEs were registered as Investment Consulting Companies (投资有限公司). However, in January 2016, the infamous P2P company named E-Zubao has vanished with over $7.6 Billion of customer funds and became the largest financial fraud case in China in modern history. It also happed to operate under WFOE Investment Consulting License out of Shanghai. As a result, the Chinese government has placed a hold on all WFOE Investment Consulting registrations until further notice. That’s why going forward we recommend all our clients to choose Management Consulting format (商务咨询有限公司). Misconception # 2. I need to have a physical office before I submit for WFOE registration. Unfortunately, most newcomers to the market fall into this trap and end up spending tens of thousands of dollars on an expensive office somewhere in downtown area of Shanghai. The matter becomes even more complicated, because oftentimes local business offices refuse to rent out an office without a local license, which forces business owners to come to even more expensive service-offices, which not always allow to use their address for registration services and if they do – be ready to pay a hefty price for it. So it all becomes almost a vicious circle – you need to have an office in order to apply for a license, but you need to have a license to be able to lease a moderately priced permanent office. In reality these expenses and headache can be avoided if you choose the right partner to help you along the registration process. Several city districts in major cities allow to obtain a virtual office address for the registration purposes. It costs a fraction of a full office rent and gives you a flexibility to choose just the right size of the office to get your local business on the way while waiting for the license application to be approved. Misconception # 3. I need to receive full paperwork for WFOE before I can start hiring staff. Although of cause, you do need a valid Chinese business license in order to be able to start hiring your local team, there are ways how you can expedite this process without waiting for your paperwork. The key here is the fact that it can be any license – e.g. of a local out-staffing agency that has the right to hire local staff and sing agreements with your offshore entity at the same time. Trade Exact solutions include this option for newly forming companies in China. Misconception # 4. I need to have hundreds of thousands of dollars as charter capital. This is another example of past legacies that firmly embedded themselves into the minds of business practitioners in China. Not long ago, Chinese government has amended the requirements for charter capital utilization, which lifted the deadlines for mandatory capital infusions. So although, it is advised that you list at least $140,000 of charter capital (which may vary depending on your company origin, business plan and corporate structure), there is no obligatory timeframe during which you need to bring this money in. Good news is – you can use charter capital for OPEX. Therefore, you can simply inject the optimal amount of funds required to have your operations running smoothly. Misconception # 5. I need to have in-house HR and accountant specialist to service the WFOE. Lastly, another managerial mistake that we often see among the newly registered companies is hiring of full-time HR and accountants, while the company itself has no more than 20 staff. According to regulations, any local company in China must submit monthly reporting to the local tax authorities, process payroll and pay various social benefits on behalf of the local staff. The truth is, there is no need to hire an in-house specialist for that. There are plenty of part-time accountants and staffing agencies, who can do this work at much better rates. If you choose to register your company with Trade Exact Consulting VIP package, we will include a full year service FREE of charge and insure your reporting and staffing needs are fully covered. |

AuthorPavel Khizhnyak, Founder & CEO Archives

April 2019

Categories |

RSS Feed

RSS Feed